Reserve Bank delivers rate hike in first interest rate decision of year — as it happened

The Reserve Bank has hiked the cash rate 0.25 percentage points to 3.85 per cent, in its first rate rise in more than two years.

The Australian dollar rallied on the rate hike, while the ASX 200 came off its highs but remained positive.

Look back on our coverage of the RBA decision and the governor's press conference, with market reaction and expert analysis.

Disclaimer: this blog is not intended as investment advice.

Key Events

Live updates

The last word

It's easy to acknowledge that the RBA is pulling its lever that punishes us mortgage holders through lifting the cash rate. My biggest question is what on earth are the government going to do to counter this and make things easier. The opposition or lack thereof are a joke and offering no alternative or constructive help for Government policy makers. When will someone actually "stand up" for middle Australia who are the silent sufferers in this cost-of-living crisis!

- Matt

If inflation is hurting the average family pay their living costs, are these families the ones contributing to the increasing inflation? If not, how can increasing their mortgage payments stress help them and reduce inflation. Is this not a con job by the banks who make more money at citizens expense and they give nothing back to the community!? Why to citizen home loan rates get changed? Just business investment rates should be changed , leave the poor citizens alone. It’s the emperors new clothes scam. Treasurer thinks it’s fine! Bank execs get a salary rise at our expense! It’s all a con job we stupidly refuse to critically question! Is it not?

- Craig

People with mortgages feeling sorry for themselves. Perhaps they should take the advice they give to people who cannot afford a mortgage: work harder, stop eating avo smash and buy where you can afford to live!

- Broke in Bondi

I'm a "middle income" person living in a modest apartment with a mortgage half that of the national average of a property, yet this increase just adds another cut to ever growing list of them bleeding me dry. I've done everything possible to reduce my costs where there are opportunities to save money. I don't go out. My family is on the other side of the country who I don't get to see. I don't have holidays. What a dismal existence it is under circumstances like this. There has GOT to be a better way to tame inflation.

- Stu

House prices need to come down so we can all afford a place to live. If interest rates need to go up to make that happen, so be it! If you're sad about paying your mortgage, you shouldn't have bought a house.

- Homeless

RBA cannot share the pain - they can only hit borrowers. It is up to Govt to share the pain more equitably. Why not a temporary "cyclical adjustment" to the top tax rate of say 2%... it gets switched on when macro circumstances dictate and switched off when the problem has been solved (in this case inflation back ~2.5%).

- Mike

Thanks for sharing your thoughts through the day here on the blog — I'll let you all have the last word.

We'll be back bright and early with the wash-up from the rate hike (banks, we're looking at you — any updates on home loan and savings rates?) and what has happened on markets overnight.

LoadingReserve Bank hikes rates as widely expected, sending Aussie dollar surging

To recap the massive afternoon, we've had a 0.25 percentage point rate hike from the RBA board, just six months since it last cut interest rates.

That takes the cash rate back to 3.85%, where it sat last July before the August rate cut.

The central bank board was unanimous in its decision and highlighted a material pick up in inflationary pressures.

The statement was read as quite hawkish by economists, and the market, leaving the door open to further rate hikes, and sending the Australian dollar back above 70 US cents —it's currently up 1% against the greenback.

Governor Michele Bullock was measured in her press conference, saying the RBA was not ruling anything in or out and would be driven by the data.

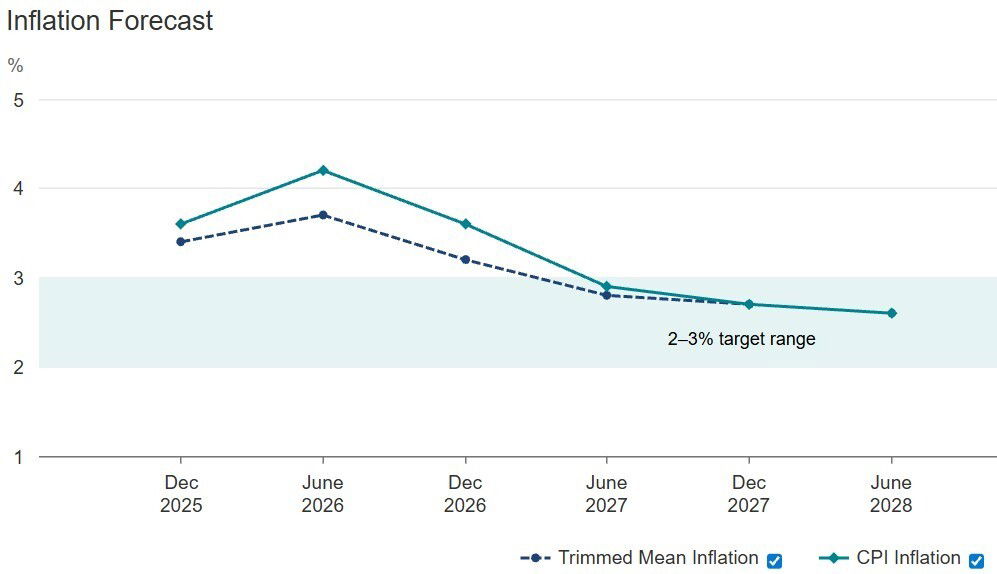

The RBA's quarterly forecasts, predicated on market forecasts of two hikes (including today's), don't have inflation returning to the central bank's 2-3 per cent target band until 2027.

It revised its GDP growth forecasts higher for the near-term, but sees growth dropping off from late 2026 onwards, as rates rise.

We're yet to hear from the major lenders on increases to variable home loan or savings rates, but stay across ABC News platforms tonight.

Nightmare on Martin Place as RBA outlines horror interest rates scenario

Our chief business correspondent Ian Verrender was down at the RBA's (current) HQ in Sydney's Chifley Square, in lock up getting an advanced reading of the central bank's quarterly Statement on Monetary Policy.

And unfortunately, he doesn't come with cheery news.

The good news is the economy ended 2025 in relatively good shape — with growth starting to pick up, the economy transitioning away from government-led spending, all while maintaining an historically strong jobs market.

Unfortunately, that's where it ends.

The bad news is that, even after today's rate hike, the latest forecasts from the Reserve Bank of Australia (RBA) describe a scenario in which inflation gathers pace, and if market expectations for two or more rate hikes come to fruition, things could turn ugly.

It's a future outlined in the quarterly Statement of Monetary Policy, which foreshadows a sharp downturn in growth, plunging household consumption, an evaporation of dwelling investment and a steady rise in unemployment through to mid-2028.

Even then, inflation wouldn't be entirely vanquished.

Read more of his analysis:

ASX closes higher, Aussie dollar above 70 US cents

A quick wrap of today's market action, which saw a definite reaction to the RBA's rate hike.

On the back of a rally on Wall Street and alongside strong gains for Asian markets (Tokyo's Nikkei is up nearly 4%), the ASX 200 enjoyed a strong session.

It came off its 1%+ peaks after the RBA hiked the cash rate and left the door open for more hikes.

The ASX 200 closed 0.9% higher.

The Australian dollar is up 0.8% against the greenback, currently around 70.05 US cents. Earlier, in the immediate aftermath of the RBA, it was closing in on 70.3 US cents.

Thanks for your comments about the RBA rate increase

Message from the reserve bank. To many people wanting to work, work hard and provide for families. You have all earnt to much money, we better make you give it to the banks again!!!! Dont stop working hard though. Middle and lower class Australians continue to suffer while the rich get richer.

- Ben

I just applied for pre-approval on a mortgage, my bad!

- Cherry

"A wide range of data over recent months have confirmed that inflationary pressures picked up materially in the second half of 2025." Well what the heck were they doing for 2025?? Living under a rock I guess?

- Gavin

We are middle income Australians with two kids. We have been juggling finances for the last few years since building a house. As parents we choose at times not to go to the optometrist or doctor due to cost and are cautious with food purchasing. We have gone without as a family for the last few years to try and help the Australian economy. As mortgage holders we are in the minority but are the only ones punished financially to fix our economy. Enough is enough. Bullock has nearly four decades of experience at the RBA and can't think of any other ways to slow inflation. Increase taxes on super earnings to slow the spend by cashed up retirees in line with the financial penalties placed on mortgage holders who are trying to finance our country's future by raising kids.

- AB

So an increase in interest rates means those people with no mortgages, are going to receive more interest income - which means they'll have more money to spend on holidays and eating out at expensive restaurants, and because I have a mortgage, I have to pay for it. Doesn't make any sense to me.

- Richard

Why not raise the rates significantly and be done with this inflation? Seems RBA has decided to bleed us out slowly.

- Martin

Keep your comments coming.

And if today's rate hike has you worried about your finances, here's some resources that could help.

- National Debt Helpline: 1800 007 007

- Financial counselling services

RBA has 'bared its teeth' but may not hike again: Bassanese

Betashares chief economist David Bassanese has issued a note with his take on today.

"The Reserve Bank has today bared its teeth by re-asserting its determination to bring down inflation," he says.

His reading is the RBA board "judges that solid demand in the face of limited spare economic capacity is also playing an important role" to push up inflation.

"Is one rate rise enough? Only time will tell."

He expects this will be a "one and done" rate hike for 2026, because the recent uptick in inflation might prove to be temporary when the March quarterly figures drop.

"Travel and hospitality costs, moreover, could have been temporarily boosted by one-off special events such as the Ashes cricket test series," he writes.

However, he writes, there is no ruling out that the RBA might have one more rate hike in mind. The market isn't ruling this one out either.

For her part, this is how the RBA's governor Michele Bullock just replied to this question about another hike to come:

"I'm not predicting there'll be more rate rises but I'm also not saying that if inflation does remain too high, that there mightn't be."

ASX 200 gains 0.9% despite pulling back from highs

Thanks to that press conference, I almost missed the local share market closing.

The ASX 200 has ended the session 0.9% higher.

So a strong gain from the Australian share market, making back most of yesterday's fall, but it did give back some of its gains after the rate hike.

The governor wraps things up

Michele Bullock steps away from the mic in Sydney after about 40 minutes of questions from reporters after this afternoon's rate hike.

Don't know if this is a tightening cycle: Bullock

My colleague David Taylor lobs a few questions at the governor.

Firstly, is monetary policy now in a tightening cycle?

Ms Bullock doesn't want to give a straight yes or no: "I would say I don't know if it is in a cycle."

"Certainly it is an adjustment… as I said earlier, the board will be actively monitoring.

"I can't say one way or another now. I don't want to rule out and I don't want to rule in.

"It is not the same as the tightening cycle when we were coming out of COVID, when we were coming from 0.1% cash rate. It was quite clear that we had to go up and we had to go up quickly.

"This isn't as clear… so I can't answer you a yes or no but what I can say is the board is going to be very actively monitoring data to try and figure out whether or not we think we've got the settings right enough to bring inflation back down to the target."

A follow up on whether that adds to the stress for borrowers from DT.

"I understand that it adds uncertainty for people, I do understand that, but as you also know I am very wary of giving forward guidance because people don't take the forward guidance in the way it is meant — they have tended to take it literally, so I don't like to give forward guidance."

The governor says we live in a very uncertain world and don't know when we wake up in the morning if something will happen elsewhere that "might throw everything out".

Government hasn't asked RBA not to comment on fiscal policy, Bullock says

Given the political interest in who can be blamed for inflation and resulting rate hikes, Ms Bullock faces another question, following up from her earlier avoidance of commenting on fiscal policy.

A reporter asks whether anyone from the government has asked her or anyone within the RBA not to comment on government spending.

"No, no-one has made that comment to me, and the board obviously makes its decisions independently of the government, so no," she says.

RBA forecasts inflation not returning to band until 2027

Michele Bullock is facing questions on how long it is forecast to take inflation to return to the RBA's 2-3% target band.

Here are its latest forecasts, which don't have headline or underlying inflation back in the target range until 2027:

And these forecasts are based on two interest rate hikes, as markets are predicting.

No regrets on cuts, says Bullock: 'I think we were doing right thing'

David Chau follows up and asks the governor if there is a bit of regret around the August rate cut, was it a mistake?

"I would take you back to the first half of last year and what we were facing into," Ms Bullock says.

She says the market was expecting three rate cuts, demand was "soggy", inflation was back in the band: "Everything was in line."

"I think we were doing the right thing. Circumstances change, we change.

"We got to change our outlook, we got to take into account the information we now have, and that's changed our outlook."

One and done? Bullock won't rule further hikes in or out

Business reporter David Chau asks Ms Bullock if the RBA is one and done with rate hikes or if it will unwind more of last year's rate cuts.

"The board has taken a cautious approach. They have made one rate rise this time and we'll observe now what happens to financial conditions," the governor says.

"We're already observing some tightening in financial conditions including through the exchange rate … we'll wait and see what the response of some of the credit, housing, those sorts of thing.

"I'm not predicting there'll be more rate rises but I'm also not saying that if inflation does remain too high, that there mightn't be."

Ms Bullock says she's essentially not ruling anything in or out.

Not driven by market expectations: Bullock

Financial markets see an increasing chance of another rate hike in May.

"What I normally say is that I don't dismiss market expectations, but I'm also not driven by them.

"The board will monitor and make its own decisions about what's appropriate and the market is taking a view on that, which is fine, but I won't basically be driven by the market," the governor said.

I'm not going to comment on fiscal policy: Bullock

The governor is asked about the Shadow Treasurer's assertions that government spending is partly to blame for rising inflation.

Ms Bullock says the central bank base their forecasts on total demand, which is public and private. And she won't be drawn on her views on current government policy, saying the RBA takes it "as given".

"Private demand has turned out to be much stronger than we had been forecasting and that, together with what we think is a bit of a weakness in supply… whereas we thought we might have been at balance, we don't think that we are now.

"We think there's excess demand. I'm not going to comment on fiscal policy because it's an independent policy … governments have to supply services … they have to build infrastructure, they have to make those policy decisions.

"We take that as given and together with private demand, look at whether or not it means that inflation is going to be under upward pressure or not. That's our focus."

'Not an acceptable outcome' for inflation to remain elevated: Bullock

"The outlook for inflation depends not just on the inflation number today, but on the strength in demand and whether the economy has capacity to meet that demand, and on global conditions as well," Ms Bullock says.

"Based on the data we have seen and the conditions here and around world, the board now thinks it will take longer for inflation to return to target and this is not an acceptable outcome."

RBA governor Michele Bullock speaking

The governor says the board concluded the cash rate was no longer at the right level to get inflation back to target.

RBA governor Bullock to speak shortly

Stick with us for live coverage of Michele Bullock's press conference.

Treasurer says private demand driving inflation

The questioning continues in Canberra in the wake of the RBA's rate hike, with Treasurer Jim Chalmers answering a question from Shadow Treasurer Ted O'Brien.

"Treasurer, as mortgage holders are hit with their 13th interest rate rise under Labor, will you now finally take responsibility?" O'Brien asks.

Chalmers says higher than expected inflation has been driven by the private sector.

"The Reserve Bank board itself has said the pressure is coming from private demand. Like his friend earlier, I encourage him to read the statement the Reserve Bank put out," Chalmers says.

Here's what the RBA statement says on demand:

"Growth in private demand has strengthened substantially more than expected, driven by both household spending and investment. Activity and prices in the housing market are also continuing to pick up."

The federal politics blog has more:

'Hawkish hike' says Capital Economics, tipping May rate rise

Some analysis coming through now from economists, most of whom will be patting themselves on the back for correctly forecasting a rate hike.

Abhijit Surya, senior economist at Capital Economics, described it as a hawkish hike by the central bank.

Mr Surya said there was a growing risk rates would need to go above the 4.1% peak, or one more 0.25 percentage point hike he has penciled in.

"Today’s statement was clearly on the hawkish side. The board acknowledged that underlying inflation had picked up materially in the second half of 2025 and that 'some of the increase in inflation reflects greater capacity pressures'.

"Overall, it's clear that the RBA believes the road to disinflation will be a long and winding one. Our base case is that the bank will only deliver one more 25bp hike, most likely in May.

"However, given that the bank doesn't expect underlying inflation to return to the mid-point of its 2-3% target even by early 2028, it's entirely possible that it will feel compelled to raise rates even higher."